Your House May Be High on the Buyer Wish List This Holiday Season

Around this time each year, many homeowners decide to wait until after the holidays to sell their houses. Similarly, others who already have their homes on the market remove their listings until the spring. Let’s unpack the top reasons why selling your house now, or keeping it on the market this season, is the best choice you can make. This year, buyers want to purchase homes for the holidays, and your house might be the perfect match.

Here are seven great reasons not to wait to sell your house this holiday season:

1. Buyers are active now. Mortgage rates are historically low, providing motivation for those who are ready to get more for their money over the life of their home loan.

2. Purchasers who look for homes during the holidays are serious ones, and they’re ready to buy.

3. You can restrict the showings in your house to days and times that are most convenient for you, or even select virtual options. You’ll remain in control, especially in today’s sellers’ market.

4. Homes decorated for the holidays appeal to many buyers.

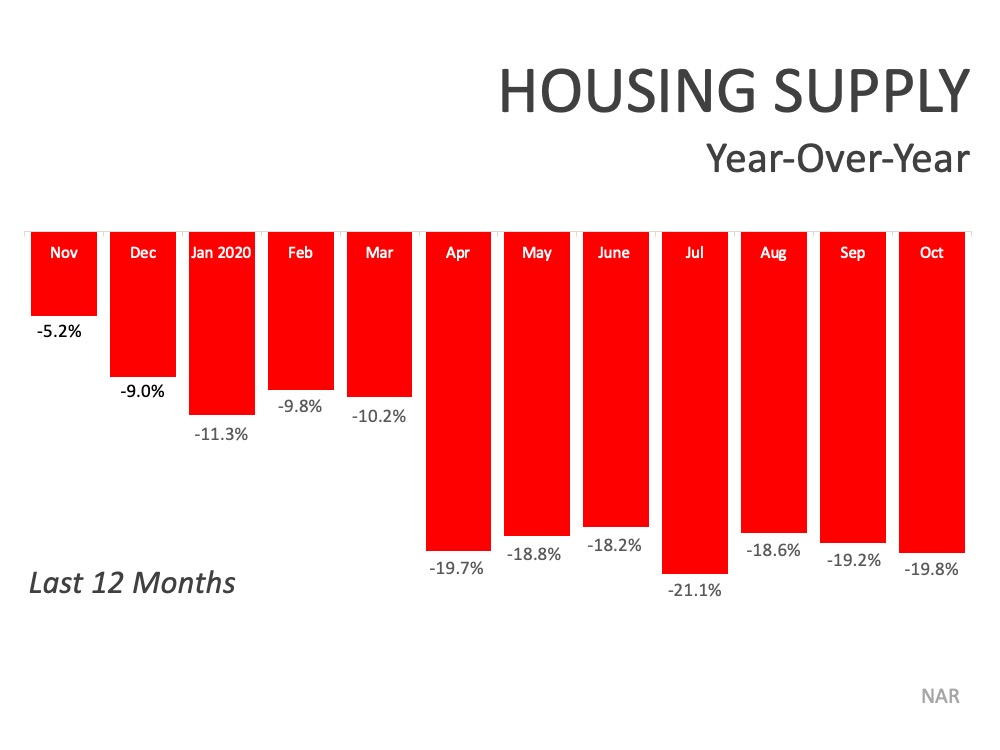

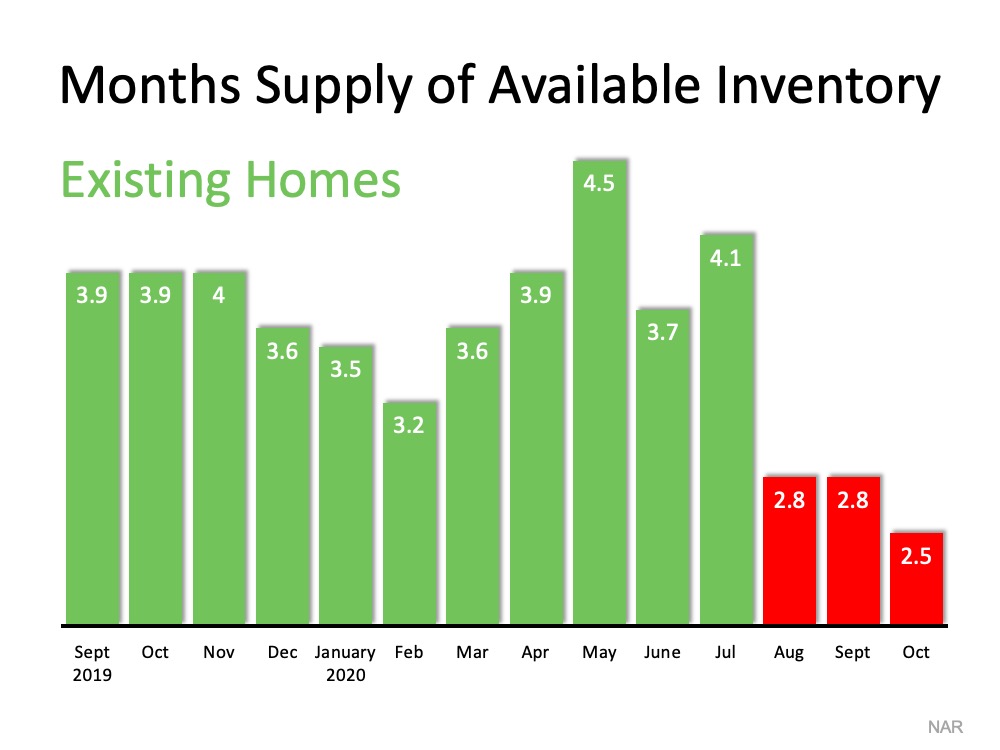

5. Today, there’s minimal competition for you as a seller. There just aren’t enough houses on the market to satisfy buyer demand, meaning sellers are in the driver’s seat. Over the past year, inventory has declined to record lows, making it the opportune time to sell your house (See graph below): 6. The desire to own a home doesn’t stop during the holidays. Buyers who have been searching throughout the fall and have been running into more and more bidding wars are still on the lookout. Your home may be the answer.

6. The desire to own a home doesn’t stop during the holidays. Buyers who have been searching throughout the fall and have been running into more and more bidding wars are still on the lookout. Your home may be the answer.

7. This season is the sweet spot for sellers, and the number of listings will increase after the holidays. In many parts of the country, more new construction will also be available for sale in 2021, which will lessen the demand for your house next year.

Bottom Line

More than ever, this may be the year it makes the most sense to list your house during the holiday season. Let’s connect today to determine if selling now is your best move.

Is Buying a Home Today a Good Financial Move?

There’s no doubt 2020 has been a challenging year. A global pandemic coupled with an economic recession has caused heartache for many. However, it has also prompted more Americans to reconsider the meaning of “home.” This quest for a place better equipped to fulfill our needs, along with record-low mortgage rates, has skyrocketed the demand for home purchases.

This increase in demand, on top of the severe shortage of homes for sale, has also caused more bidding wars and thus has home prices appreciating rather dramatically. Some, therefore, have become cautious about buying a home right now.

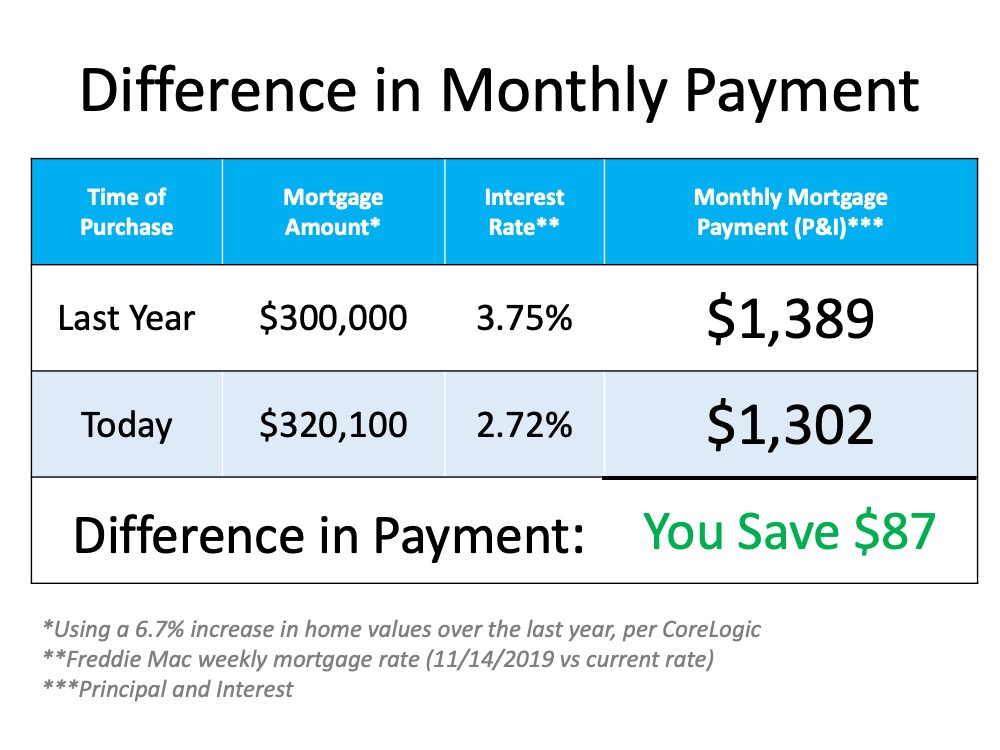

The truth of the matter is, even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped. This is largely due to mortgage rates falling by a full percentage point.

Let’s take a look at the monthly mortgage payment on a $300,000 house one year ago, and then compare it with that same home today, after it has appreciated by 6.7% to $320,100: Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

Compared to this time last year, you’ll actually save $87 dollars a month by purchasing that home today, which equates to over one thousand dollars a year.

But isn’t the economy still in a recession?

Yes, it is. That, however, may make it the perfect time to buy your first home or move up to a larger one. Tom Gil, a Harvard trained negotiator and real estate investor, recently explained:

“When volatile assets are facing recessions, hard assets, such as gold and real estate, thrive. Historically speaking, residential real estate has done better compared to other markets during and after recessions.”

That thought is substantiated by the fact that homeowners have 40 times the net worth of renters. Odeta Kushi, Deputy Chief Economist for First American Financial Corporation, recently said:

“Despite the risk of volatility in the housing market, numerous studies have demonstrated that homeownership leads to greater wealth accumulation when compared with renting. Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments, which become a form of forced savings for homeowners.”

Bottom Line

With home prices still increasing and mortgage rates perhaps poised to begin rising as well, buying your first home, or moving up to a home that better fits your current needs, likely makes a ton of sense.

Don’t Let Buyer Competition Keep You from Purchasing a Home

This year’s record-low mortgage rates sparked high demand among homebuyers. Current homeowners, however, haven’t put their houses on the market so quickly. This makes finding a home to buy today challenging for many potential buyers. With an obstacle like this, those searching for their dream homes may be pressing pause on their searches as we approach the end of the year, but that could be a big mistake for many hopeful house hunters. Here’s why.

According to the most recent Housing Trends Report from the National Association of Home Builders (NAHB):

“The length of time spent searching for a home continues to grow.”

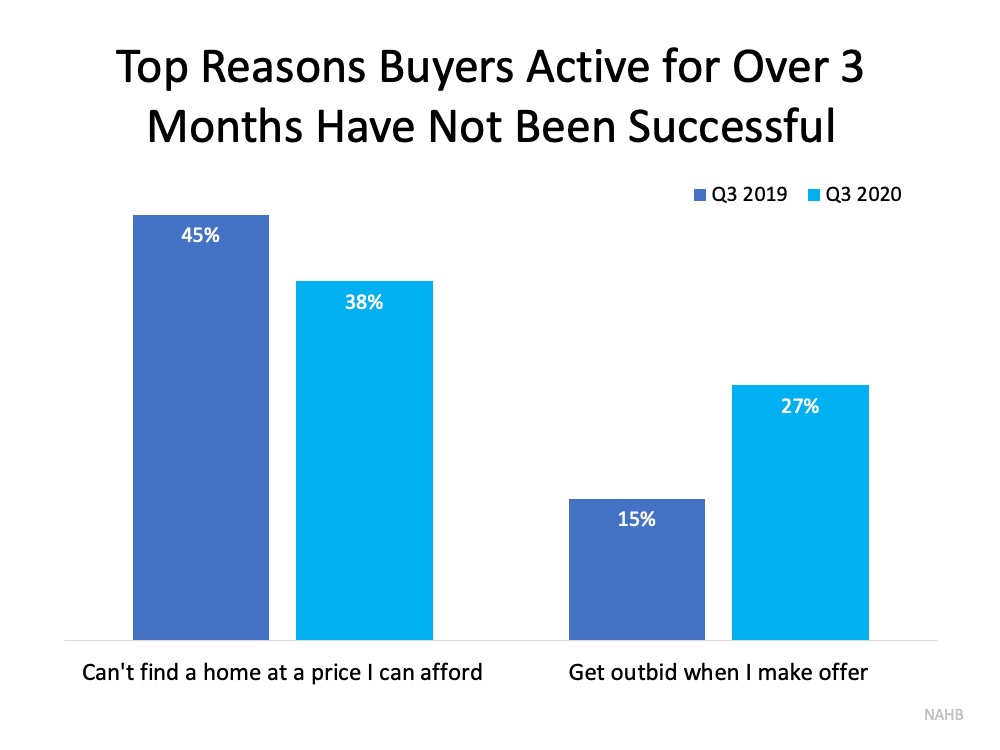

The report indicates that 62% of buyers now spend 3 months or more looking for a home, an increase from 58% one year ago. A primary cause for the delay is the heavy competition today’s buyers face when making an offer on a home. Based on recent data from the National Association of Realtors (NAR), the average house in today’s market receives 3.4 offers before it’s sold. This means for every buyer who purchases a home, there are on average two or three buyers who have to begin their search all over again.

Compared to this time last year, the NAHB report shows that buyers are having more success finding homes in their price range. However, it also notes the percentage of buyers saying they’re getting outbid when they make an offer has jumped from 15% to 27%. Buyers are indicating that bidding wars are a major obstacle to finding their dream home (See graph below): If this is a challenge you’re up against in your home search, you’re not alone. Feeling stuck in the process can be frustrating, but if there’s ever been a year to power through, this is the one. NAHB noted:

If this is a challenge you’re up against in your home search, you’re not alone. Feeling stuck in the process can be frustrating, but if there’s ever been a year to power through, this is the one. NAHB noted:

“Difficulties finding a home to buy will likely lead 20% of active buyers to give up until next year or later. That share is up from 15% a year earlier.”

Experts anticipate home prices will continue to rise into 2021, and the incredibly low interest rates we’ve seen this year are also forecasted to increase as the economy strengthens. Hopeful homebuyers who decide to hold off on their search until there’s less competition run the risk of finding a more expensive housing market when they start looking again. If affordability is a key motivator behind your decision to buy a home, this winter is still the best time to make it happen.

Bottom Line

Bidding wars may be one of the greatest challenges buyers face in today’s housing market, but they shouldn’t be a deal-breaker. Having the right expert on your side throughout the buying process will give you the advantage you need when it comes to finding the right home and making a competitive offer. If you’re ready to buy this winter, let’s connect to discuss how to position yourself for success.

It Pays to Sell with a Real Estate Agent

![It Pays to Sell with a Real Estate Agent [INFOGRAPHIC] | MyKCM](http://homefinderatx.com/files/2020/11/20201120-MEM-1046x3014-2.png)

![It Pays to Sell with a Real Estate Agent [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/11/18152639/20201120-MEM-1046x3014.png)

Some Highlights

- Today, it’s more important than ever to have an expert you trust to guide you as you sell your house.

- From your safety throughout the process to the complexity of negotiating the deal, you need a professional on your side.

- Before you decide to take on the challenge of selling your house on your own, let’s connect to discuss your options.

Will Mortgage Rates Remain Low Next Year?

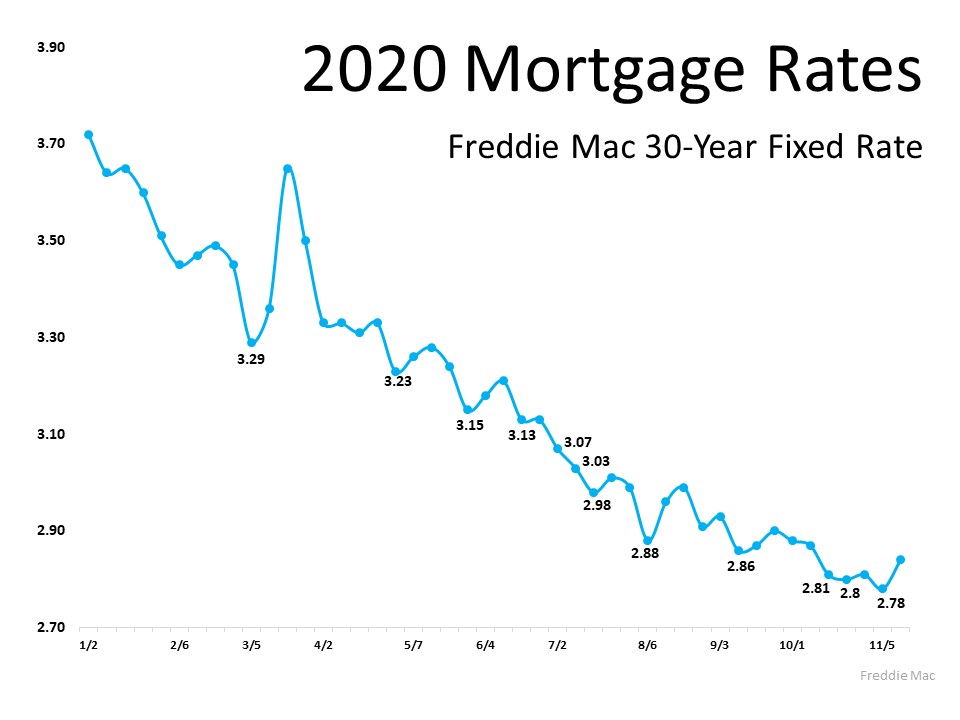

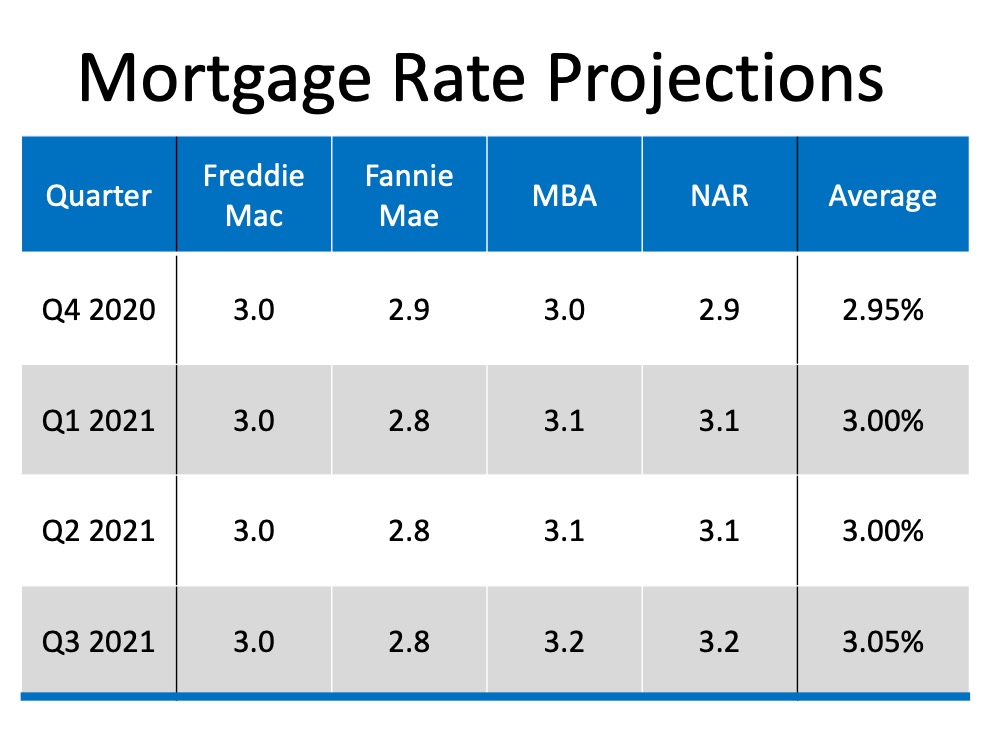

In 2020, buyers got a big boost in the housing market as mortgage rates dropped throughout the year. According to Freddie Mac, rates hit all-time lows 12 times this year, dipping below 3% for the first time ever while making buying a home more and more attractive as the year progressed (See graph below): When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

The Challenge with Waiting

The challenge with waiting is that you can easily miss this optimal window of time and then end up paying more in the long run. Last week, mortgage rates ticked up slightly. Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates jumped this week as a result of positive news about a COVID-19 vaccine. Despite this rise, mortgage rates remain about a percentage point below a year ago.”

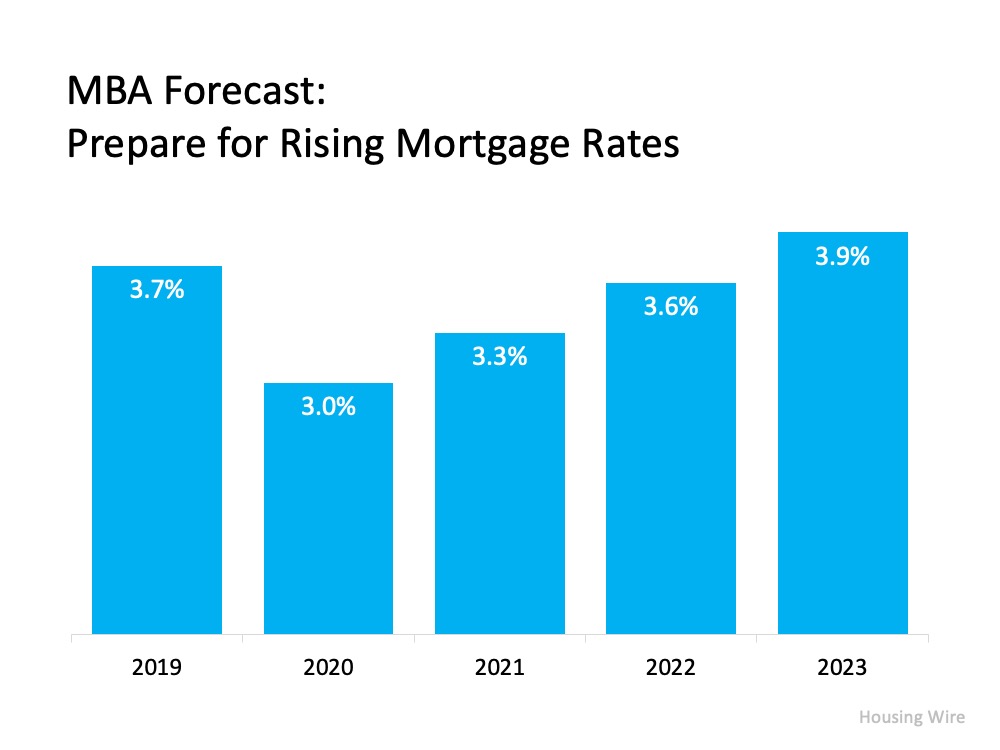

While rates are still lower today than they were one year ago, as the economy continues to get stronger and the pandemic is resolved, there’s a very good chance interest rates will rise again. Several top institutions in the real estate industry are projecting an increase in mortgage rates over the next four quarters (See chart below): If you’re planning to wait until next year or later, Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), forecasts mortgage rates will begin to steadily rise:

If you’re planning to wait until next year or later, Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), forecasts mortgage rates will begin to steadily rise: As a buyer, you need to decide if waiting makes financial sense for you.

As a buyer, you need to decide if waiting makes financial sense for you.

Bottom Line

If you’re planning to buy a home and want to take advantage of today’s low rates, now is the time to do so. Don’t assume they’re going to stay this low forever.

Chances of Another Foreclosure Crisis? “About Zero Percent.”

There seems to be some concern that the 2020 economic downturn will lead to another foreclosure crisis like the one we experienced after the housing crash a little over a decade ago. However, there’s one major difference this time: a robust forbearance program.

During the housing crash of 2006-2008, many felt homeowners should be forced to pay their mortgages despite the economic hardships they were experiencing. There was no empathy for the challenges those households were facing. In a 2009 Wall Street Journal article titled Is Walking Away From Your Mortgage Immoral?, John Courson, Chief Executive of the Mortgage Bankers Association, was asked to comment on those not paying their mortgage. He famously said:

“What about the message they will send to their family and their kids?”

Courson suggested that people unable to pay their mortgage were bad parents.

What resulted from that lack of empathy? Foreclosures mounted.

This time is different. There was an immediate understanding that homeowners were faced with a challenge not of their own making. The government quickly jumped in with a mortgage forbearance program that relieved the financial burden placed on many households. The program allowed many borrowers to suspend their monthly mortgage payments until their economic condition improved. It was the right thing to do.

What happens when forbearance programs expire?

Some analysts are concerned many homeowners will not be able to make up the back payments once their forbearance plans expire. They’re concerned the situation will lead to an onslaught of foreclosures.

The banks and the government learned from the challenges the country experienced during the housing crash. They don’t want a surge of foreclosures again. For that reason, they’ve put in place alternative ways homeowners can pay back the money owed over an extended period of time.

Another major difference is that, unlike 2006-2008, today’s homeowners are sitting on a record amount of equity. That equity will enable them to sell their houses and walk away with cash instead of going through foreclosure.

Bottom Line

The differences mentioned above will be the reason we’ll avert a surge of foreclosures. As Ivy Zelman, a highly respected thought leader for housing and CEO of Zelman & Associates, said:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

Homes for Sale Are Rapidly Disappearing

Through all the challenges of 2020, the real estate market has done very well, and purchasers are continuing to take advantage of historically low mortgage rates. Realtor Magazine just explained:

“While winter may be typically a slow season in real estate, economists predict it isn’t likely to happen this year…Low inventories combined with high demand due to record-low mortgage rates is sending buyers to the market in a flurry.”

However, one challenge for the housing industry heading into this winter is the dwindling number of homes available for sale. Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), recently said:

“There is no shortage of hopeful, potential buyers, but inventory is historically low.”

In addition, Danielle Hale, Chief Economist for realtor.com, notes:

“Fewer new sellers coming to market while a greater than usual number of buyers continue to search for a home causes inventory to continue to evaporate.”

One major indicator the industry uses to measure housing supply is the months’ supply of inventory. According to NAR:

“Months’ supply refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace.”

Historically, six months of supply is considered a normal real estate market. Going into the pandemic, inventory was already well below this mark. As the year progressed, the supply has was reduced even further. Here is a graph showing this measurement over the last year:

What does this mean if you’re a buyer?

Be patient during your home search. It may take time to find a home you love. Once you do, be ready to move forward quickly. Get pre-approved for a mortgage, be prepared to make a competitive offer from the start, and understand how the shortage in inventory has led to more bidding wars. Calculate just how far you’re willing to go to secure a home if you truly love it.

What does this mean if you’re a seller?

Realize that, in some ways, you’re in the driver’s seat. When there’s a shortage of an item at the same time there’s a strong demand for it, the seller is in a good position to negotiate. Whether it’s the price, moving date, possible repairs, or anything else, you’ll be able to ask for more from a potential purchaser at a time like this – especially if you have multiple interested buyers. Do not be unreasonable, but understand you probably have the upper hand.

Bottom Line

The housing market will remain strong throughout the winter and heading into the spring. Know what that means for you, whether you’re buying, selling, or doing both.

Why Working from Home May Spark Your Next Move

If you’ve been working from home this year, chances are you’ve been at it a little longer than you initially expected. Businesses all over the country have figured out how to operate remotely to keep their employees healthy, safe, and productive. For many, it may be carrying into next year, and possibly beyond.

While the pandemic continues, Americans are re-evaluating their homes, floorplans, locations, needs, and more. Some need more space, while others need less. Whether you’re renting or own your home, if remote work is part of your future, you may be thinking about moving, especially while today’s mortgage rates are so low.

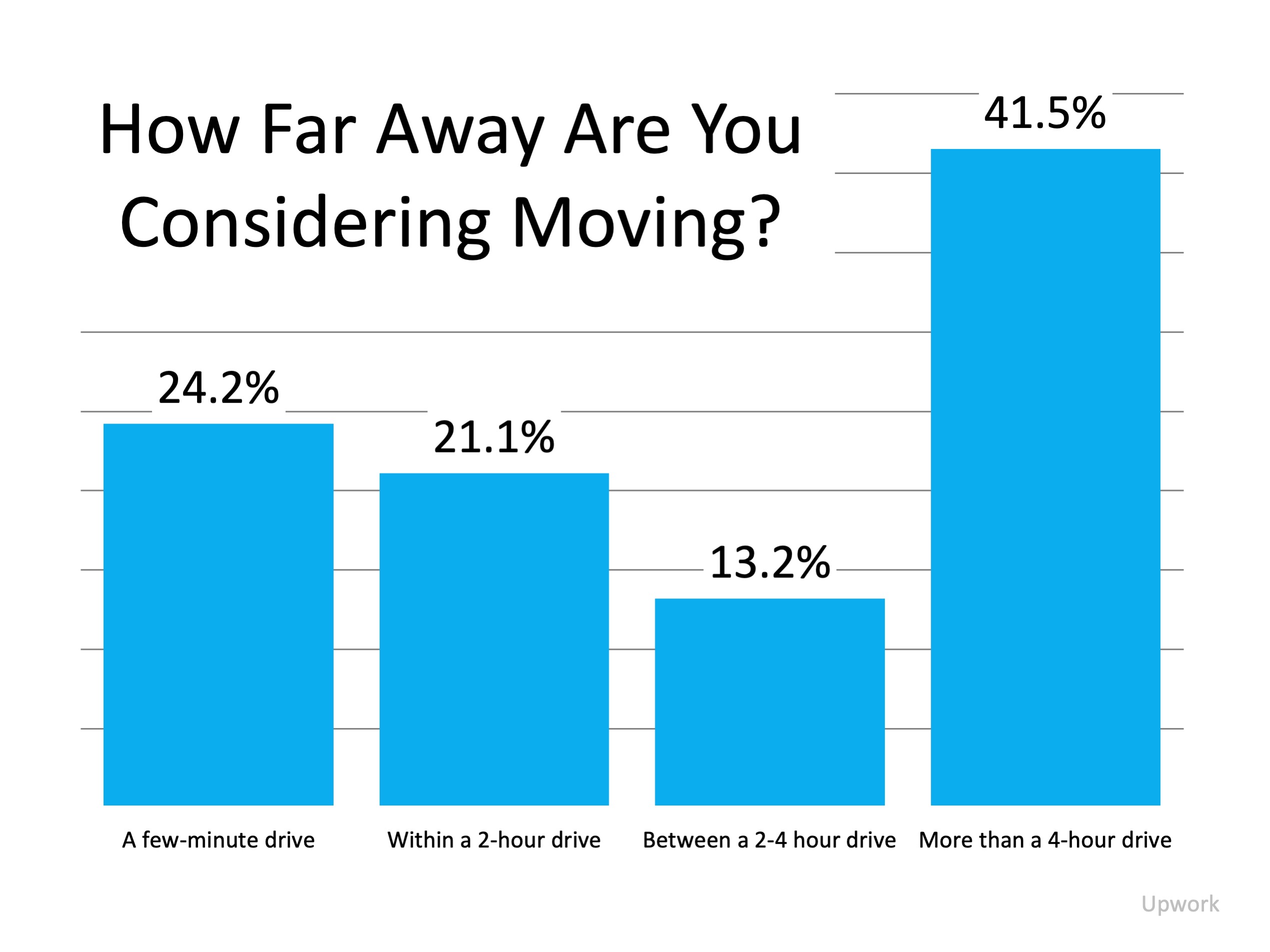

A recent study from Upwork notes:

“Anywhere from 14 to 23 million Americans are planning to move as a result of remote work.”

To put this into perspective, last year, 6 million homes were sold in the U.S. This means roughly 2 – 4X as many people are considering moving now, and there’s a direct connection to their ability to work from home.

The same study also notes while 45.3% of people are planning to stay within a 2-hour drive from their current location, 41.5% of the people who are citing working from home as their primary reason for making a move are willing to look for a home more than 4 hours away from where they live now (See graph below): In some cases, moving a little further away from your current location might mean you can get more home for your money. If you have the opportunity to work remotely, you may have more options available by expanding your search. Upwork also indicates, of those surveyed:

In some cases, moving a little further away from your current location might mean you can get more home for your money. If you have the opportunity to work remotely, you may have more options available by expanding your search. Upwork also indicates, of those surveyed:

“People are seeking less expensive housing: Altogether, more than half (52.5%) are planning to move to a house that is significantly more affordable than their current home.”

Whether you can eliminate your daily commute to the office, or you simply need more space to work from home, your plans may be changing. If that’s the case, it’s time to connect with a local real estate professional to assess your evolving needs and determine your path together.

Bottom Line

This has been a year of change, and what you need in a home is no exception. Let’s connect today to make sure you have expert guidance on your side to help you find a home that fits your remote work needs.

Tips to Sell Your House Safely Right Now

![Tips to Sell Your House Safely Right Now [INFOGRAPHIC] | MyKCM](http://homefinderatx.com/files/2020/11/20201113-MEM-1046x1641-2.png)

![Tips to Sell Your House Safely Right Now [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/11/12090934/20201113-MEM-1046x1641.png)

Some Highlights

- Your agent now has over 6 months of experience selling houses during the pandemic and can make the process easier and safer for you today.

- COVID-19 protocols and technology usage recommendations from the National Association of Realtors (NAR) are making it possible to sell houses right now, while agents continue to abide first and foremost by state and local regulations.

- Let’s connect to discuss how to sell your house safely in today’s housing market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link